It is hard to find adequate words to describe 2022. At the beginning of 2022, as Covid dissipated, there was hope of a return to normality and stable economic activity. By the end of February, it was clear that there would be no return to normality.

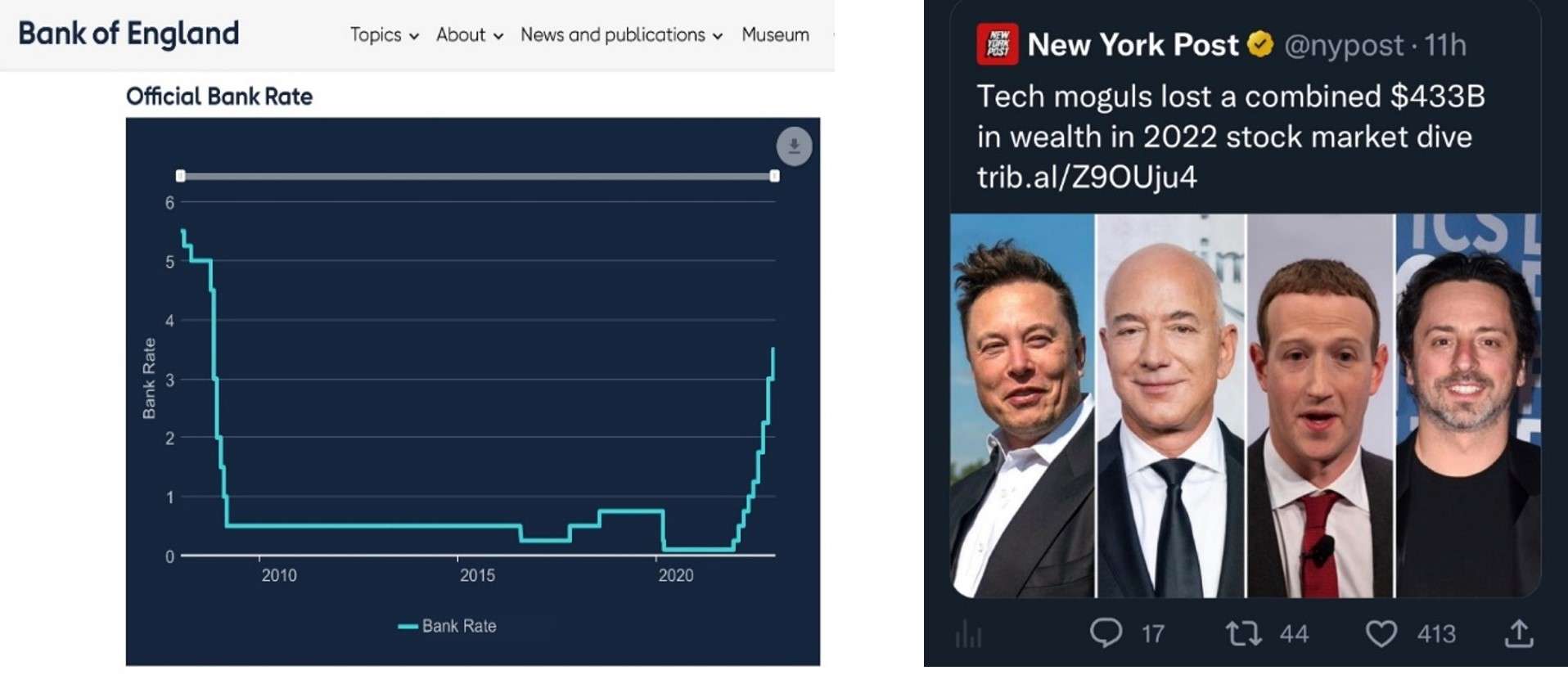

A European country was invaded, and a disastrous human tragedy unfolded with economic consequences felt far and wide. Fuelled by inflation panic, central banks put up interest rates at a record-breaking pace and capital markets plunged having not expected the aggressive response from central banks. At the same time, in connection with all these things, there was political uncertainty around the world not least in the UK which churned through 3 Prime Ministers and 4 finance ministers in 3 months. It was a tumultuous year that will long be remembered for all the wrong reasons.

Showing resilience

Against this backdrop, the Outward portfolio was resilient. Most of the portfolio was well capitalised and did not have to fundraise in 2022. The seven companies (Bud, Mazepay, Monese, Oneday, Orbital Witness, Peppy and PrimaryBid) that did raise follow-on funding did so at improved valuations which is remarkable as most of these follow-on rounds completed in Q4 when the growth stage investment market was at its most defensive and many fundraisings in the market were down rounds or failing to complete. These follow-on funding rounds involved an impressive array of new investors and will be announced to the public in the coming weeks.

None of these follow-on fundraisings were straight-forward and required tremendous tenacity from our founders who had to contend with a new world of elongated and unpredictable investor due diligence.

The Outward team was closely involved in all these follow-on fundraisings, helping our founders navigate and structure their funding rounds, and introducing new co-investors. None of these follow-on fundraisings were straight-forward and required tremendous tenacity from our founders who had to contend with a new world of elongated and unpredictable investor due diligence. At the same time, our founders were also taking difficult headcount decisions to secure the long-term future of their businesses, whilst juggling family commitments, supporting Ukrainian team members, and relocating themselves and their families as their businesses expanded internationally.

UK fintech overall has been resilient

UK fintech overall has been resilient. While global investment in fintech decreased in 2022, the decrease in investment in UK fintech was a much smaller decrease than the global average. The UK and US remain the world’s top 2 destinations for fintech investment, however, investment in fintech in the US decreased over 10% from 2021 compared to 5% for the UK.

What comes next?

The macro-economic environment remains challenging in 2023. There is no end in sight to the war in Ukraine and there is much uncertainty over China’s re-opening and whether the US can avoid a recession. While this downturn could turn out to be relatively shallow as it does not have the structural problems of the 2008 financial crisis, there remains a great deal of geo-political uncertainty.

We will be advising our founders to hope for the best while preparing for the worst...

If 2022 taught us anything, it is to take nothing for granted. We will be advising our founders to hope for the best while preparing for the worst. Navigating these conditions requires a new playbook. On follow-on funding, our founders should assume a much more conservative market looking for shorter paths to profitability and more efficient use of capital. On business development, growth plans will need to be sustainable with less reliance on paid growth.

As we start 2023, many of our founders are on the front foot having grown their businesses substantially in 2022, adjusted long-term plans, optimised their teams and secured new funding. We will be working closely with our founders to help them navigate these uncertain conditions and leveraging our dedicated fintech network to provide maximum options for funding and commercial partnerships.

About the author

Kevin Chong

Co-Head – Investment Commitee

A British-Australian-Malaysian-Chinese married to a Canadian, Kevin found his way to the venture capital industry following careers in banking and consulting. Founding his own businesses gave him a deep appreciation that there is no gain without a little pain and that fortune habitually favours the brave.