Why VC

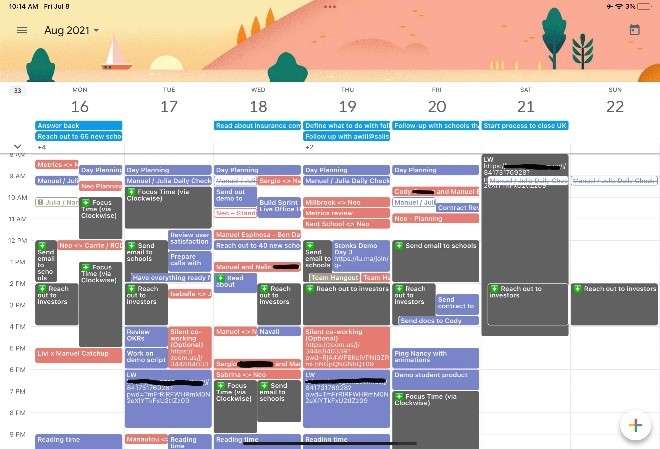

A year ago, I was living in New York, running my first startup, Neo, and my team and I were working nonstop on a mission to change the way teens learn about Health Education (Social-Emotional learning and Sex Ed) in schools. I was trying to raise our first round of funding with institutional investors, which meant my calendar looked like a poor game of Tetris. Regardless of how intense it was, I was enjoying it. I had a “prepared mind” where I felt confident pitching to VCs and talking to all stakeholders – clients, users, and team members. Unfortunately, due to many factors, things didn’t turn out as expected, and after a good run, we were forced to close down the company.

Coming away from this experience, I knew I wanted to stay as close to the entrepreneurial world as possible.

Preparing for interviews

Having pitched to countless VCs, and with some experience gained through summer internships, my understanding of a Venture Capitalist was to find the best people behind the biggest problems and understand how their idea could become the next big thing. In hindsight and following 5 months at Outward VC, I wasn’t far off, but I had no idea how difficult the interview process would be, and how difficult the day-to-day would be.

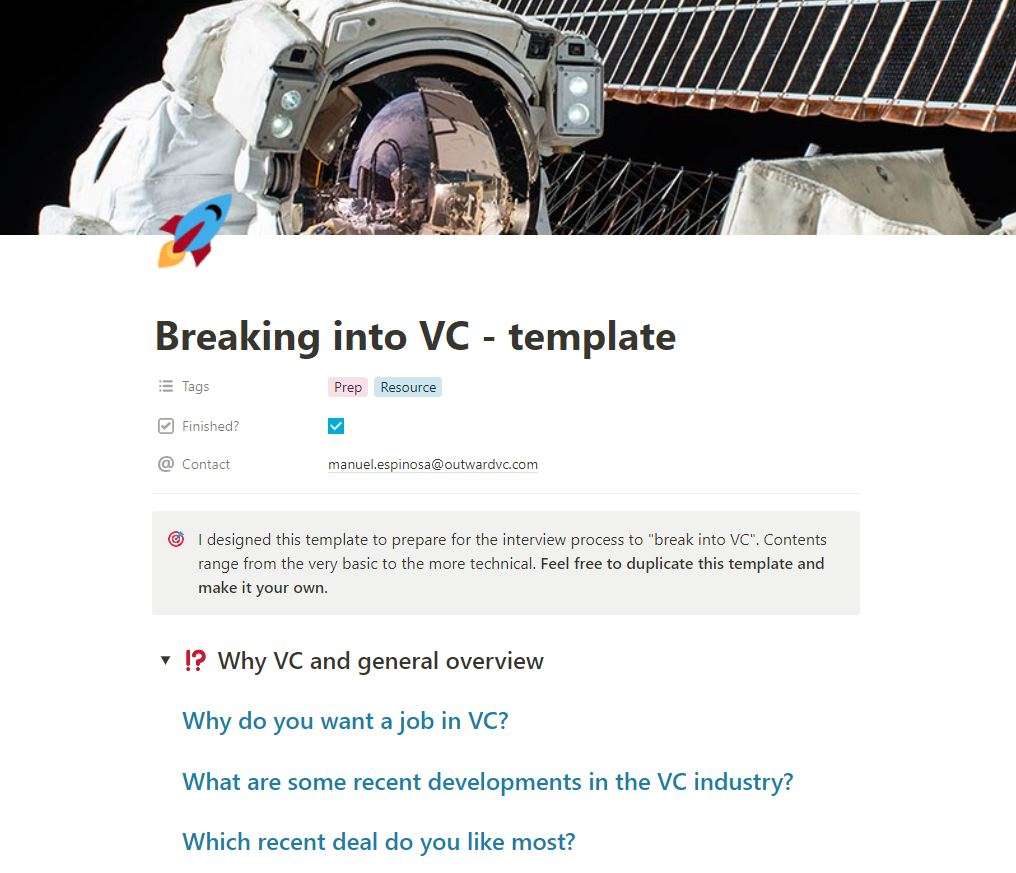

Preparing for the interviews was a lengthy and intimidating process; I had to ensure that I added value and that my interests and skills aligned with the fund’s investment thesis. This is very important because if you’re not passionate about what the VC is focused on – be it stage, sector or approach it’s not going to be a good fit. I built this framework to help me during the process. I needed to jot down notes and have a clear understanding of what I was bringing to the table as well as what they valued and sought in the market. It’s worth noting that I never used the framework as a transcript during the interviews, and I wouldn’t recommend it.

Choosing the right VC

After many conversations and rounds of interviews, I received a few offers and decided to join the Outward team. This decision involved several factors, but mainly that I wanted to be part of a small team with extensive experience and a clear vision. Being a part of a small, first-time fund has meant I’ve gained exposure across all the elements that make up a VC: from sourcing and selecting new companies, to managing the constantly changing demands of the existing portfolio, to raising our second fund – all alongside a war and an abrupt shift to a bear market.

I also have a seat at a smaller table which means access to everyone in the team and the chance to be in the spotlight, sharing my thoughts on different companies and trends. The reason I am mentioning this is that some may prefer to have a more structured work environment, where there is a clear segregation of tasks, and your role is more defined. From what I hear, this is usually the case for larger teams.

The learning curve

Regardless of the industry, there’s always a learning curve, and in the case of VC, I’ve noticed there are certain inflection points. These inflection points represent key skills you constantly need to work on.

- Connecting the dots is the first tipping point. In Outward’s case, we focus on fintech, so it’s about understanding how the various spaces within fintech (InsurTech, PropTech, POS/payments, retail investing/secondary market) interact with one another, and how the technology in one market or a legislative tailwind may impact another.

- Second, is about keeping questions broad enough to let the founder expand on the topic and guide you through their vision. Attempting to match the founder’s expertise on the subject by narrowing the questions to technicalities can distract you from the bigger picture. I think of VC as a game of ‘Guess Who?’ where you go from broad questions like hair colour (market competitors) to little things like if they have glasses (how their API works). In the interview process, this is being tested by asking you questions where you most likely don’t have the right answer, but they’re looking to understand how you would get there.

- The third and final inflection point is extrapolating the solution to determine how all stakeholders will be affected and whether the product/service has the potential to broaden the current market. Given the early stage of the businesses we encounter, this exercise is especially difficult, so it’s really about being able to put on an optimist hat while also understanding what other players in the space are doing differently

Concluding thoughts

Breaking into VC is not easy. Your job is to think and debate with some of the smartest people. There are a few things I can recommend to someone that wants to break into VC: work to build conviction, be open to being frequently wrong, and always stay optimistic.

About the author

Manuel Espinosa

Investment Analyst

Born and raised in Mexico, Manuel has always had a passion for exploring places and ideas, which has led him to not only live in five countries but also dive into the role of founder when he built an EdTech startup in 2020. Armed with the invaluable experience that comes with building and winding down a company. Manuel moved into VC to stay close to the adrenaline of the entrepreneurial world whilst sleeping easier at night. He enjoys playing padel, golf, and complaining about the quality of London’s tacos.