For consumers, technology has made purchasing easier, faster and more flexible than ever before. We make payments on the go from digital wallets in our phones, in any currency (at fair rates!), we can even go back in time to make changes and add credit. Change is happening so quickly in some parts of the world that consumers are leaping from cash to mobile payments without ever owning a plastic card.

Yet, in our working lives, purchasing and payments for B2B transactions is more painful than ever. Ironically, B2B payments (exceedingly $100 trillion globally) is many times larger than B2C payments. Before making a payment, there is a multitude of tasks to be completed – AML, Know-Your-Supplier, credit checks, and multi-stakeholder approvals. These tasks involve complex and dispersed internal systems that have to be maintained and audited. Then the payment itself is often a manual process involving bank transfers. For employees, the entire process is a time consuming and painful experience. For employers, the all-in cost of processing these purchases cannot be justified.

With their product vision and execution prowess, the Mazepay team is ready to scale in an exciting market

With a number of us in the Outward team having worked in a wide range of corporate environments and experienced first-hand the pain of procurement and payments, we immediately connected with Mazepay’s ambition to re-invent corporate spending. But it was two further factors that gave us the conviction to invest.

Firstly, the team’s go-to-market strategy impressed us. Enterprise sales for a start-up is a challenge not to be underestimated. In Soren and Dan, we have two founders who have lived and breathed enterprise sales (Amadeus, IBM, Sailpoint, Sun Microsystems) all around the world. Perhaps because of their experience, they recognised the importance of partnerships from day one. Their partnerships with Nordea and SEB Kort are win-win partnerships. Without having to make any capital investment, the banks gain a product that solves a real and growing problem for their corporate clients and, in doing so, generates new revenue that is potentially multiples of existing cards business. For the clients, it means transformational cost savings, happier employees and the opportunity to have a much more productive relationship with suppliers.

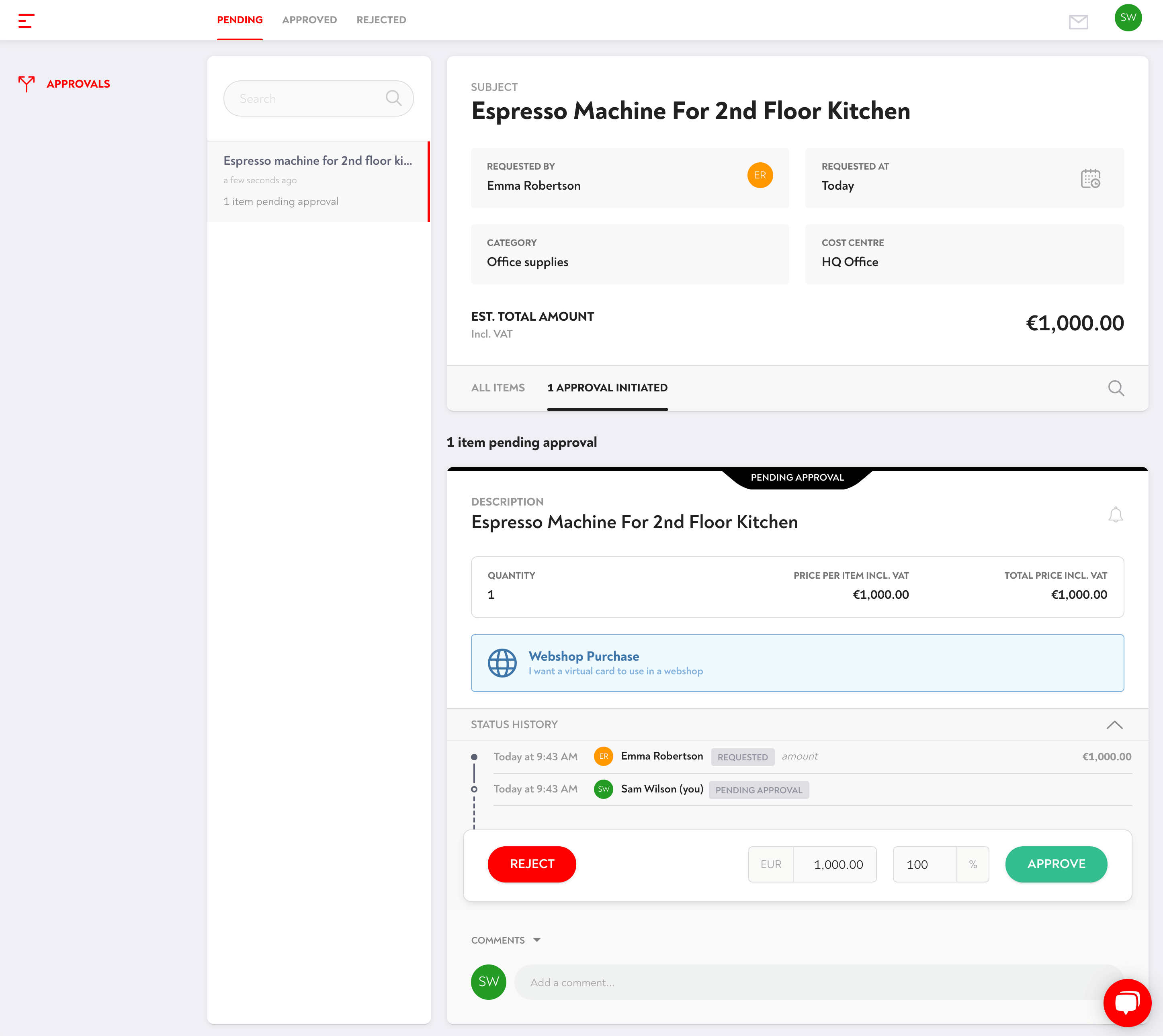

Payments needed to be as simple and familiar as in everyday personal purchases

The second factor was the team’s product vision. Mazepay was conceived as an end-to-end solution. Processing and compliance pain around B2B spending is half the problem. The other half is making the payment. Mazepay recognised that, for employees to want to adopt Mazepay, payments needed to be integrated in the platform and that payments functionality needed to be as simple and familiar as in everyday personal purchases. To achieve this, Mazepay struck another partnership – with Mastercard. Mazepay’s third co-founder, Thomas, has architected the Mazepay platform to seamlessly integrate a range of payment options including configurable virtual cards for maximum flexibility in an enterprise environment.

With their product vision and execution prowess, the Mazepay team is ready to scale in an exciting market and we are privileged to have the opportunity to be involved!

About the author

Kevin Chong

Co-Head – Investment Commitee

A British-Australian-Malaysian-Chinese married to a Canadian, Kevin found his way to the venture capital industry following careers in banking and consulting. Founding his own businesses gave him a deep appreciation that there is no gain without a little pain and that fortune habitually favours the brave.