At Outward, we’re looking to back visionary founders tackling entrenched industry pain points with cutting-edge solutions. The reinsurance market, a critical engine powering the insurance industry, has long been plagued by inefficiency and complexity. Enter Supercede, a company brilliantly positioned to revolutionise this space.

Revolutionising Reinsurance

Reinsurance is the lifeblood of the insurance world, allowing insurers to transfer portions of their risk portfolios for a sum. Pretty much every insurance company on earth buys reinsurance. Yet, this process is notoriously cumbersome and inefficient. The global reinsurance market today stands at around $400 billion, and the potential for improvement is enormous. Treaty reinsurance contracts dominate this market, but for every dollar of reinsurance placed, countless resources are wasted in time, effort, and frustration. Supercede is changing that.

Supercede’s Game-Changing Approach

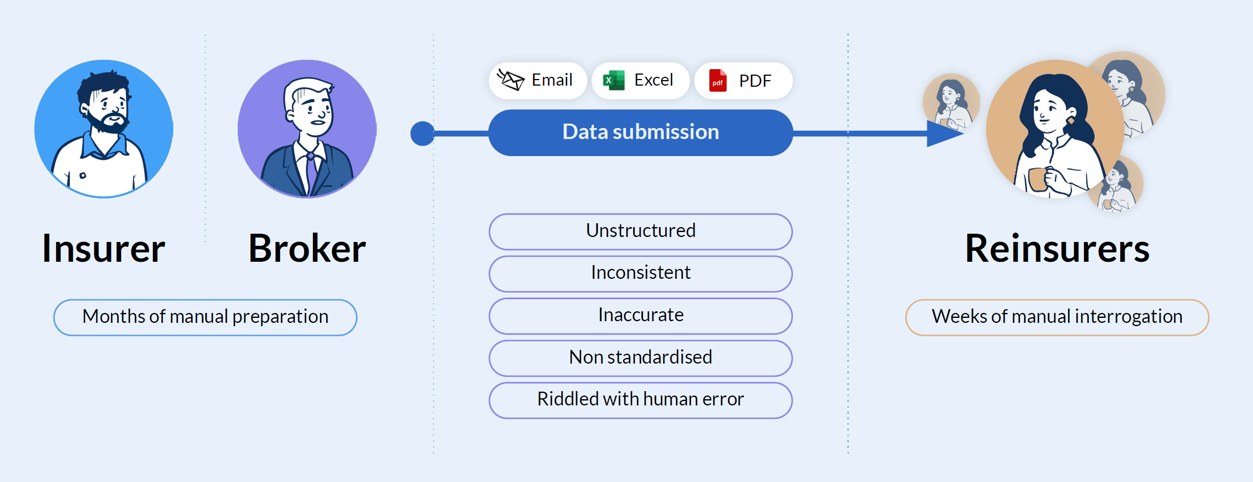

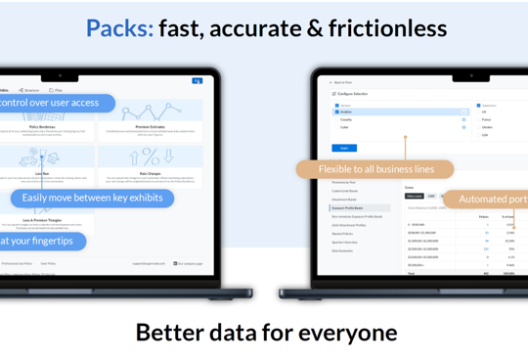

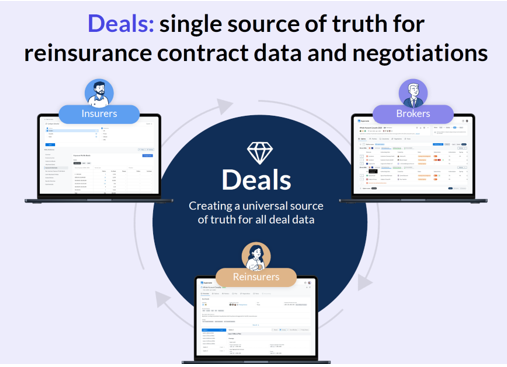

Supercede is tackling these inefficiencies head-on, starting with the pre-placement process for any reinsurance transaction. Their platform initially brings standardisation to the reinsurance buying process, allowing insurance companies and brokers to share their data, which is then auto-validated and analysed to produce complex exhibits. This eliminates the need for the labour-intensive manual construction of these documents in excel and over countless emails – a true game changer. The Supercede ecosystem then brings the various participants together in one place to get deals done without delay.

Founders with Unmatched Industry Insight

Supercede Founders Jerad Leigh and Ben Rose, exemplify incredible founder-market fit, bringing deep industry knowledge and a clear understanding of where the reinsurance industry is headed. They’ve identified that poor data quality adds an estimated $40 billion annually to reinsurance costs. With Co-Founder Jezen Thomas adding robust technological expertise, the team has created a solution that is both innovative and deeply rooted in industry realities.

Seizing a Significant Market Opportunity

The reinsurance market is at an interesting juncture post-Covid, driven by insurers seeking coverage for market entries, withdrawals, catastrophe protection, and capacity relief. Regulatory pushes, such as Lloyd’s mandate for electronic trading, underscore the need for streamlined, digital solutions. Supercede is uniquely positioned to enable the industry, occupying a white space in the market with little effective competition.

Demonstrated Impact and Strong Growth

Supercede’s impact is evident. The platform usage jumped by 200% in 2023, highlighting their role in leading the industry’s digital transformation. Supercede now serves insurance companies and brokers across four continents. This strong engagement saw $61 billion in underlying premium placed on their platform this year, up from $24 billion in 2023, with 194 reinsurance companies now utilizing Supercede – representing over 95% of the market.

Validation and Future Vision

Supercede’s partnerships with industry giants like Markel and Generali validate their platform’s capability. The recent $15 million Series A funding round, led by leading growth investors Alven and Mundi Ventures, and with further participation from Outward, will be used to accelerate growth and cement their leadership within the space.

We invested in Supercede because they’re not just solving a problem—they’re transforming an industry. With strong validation from industry leaders, Supercede is set to become the central, data-driven platform for the reinsurance sector. We’re excited to continue supporting the team on their journey and into the next phase of growth.

About the author

Sanchit Dhote

Investment Manager

Sanchit used to spend half his day as an engineer and the other half as a football coach, which meant that he was always searching for answers. After building a unique perspective he forged an unexpected path into venture capital and has become an integral part of Outward. Beyond work, Sanchit is usually found travelling to watch live sport or visiting family in his hometown of Bombay.