Outward VC led the £5m investment round joined by Kamet Ventures, Triple Point Ventures and leading angel investors from the insurance industry including Nic Kohler (Ex-CEO of Hollard Insurance) and Paul Evans (Chairman of Allianz and Board Member of Bupa and Swiss RE Europe).

It’s safe to say there has been a coming of age in European insurtech in the last 12 months. However, when most people talk about the impact of insurtech today it is often in Property and Casualty insurance (P&C) – i.e. the increasingly well understood segments of motor, home, pet, etc.

But wait till you hear about the life insurance industry, which in the UK alone is worth almost £180bn annually and comprises 70% of all gross premiums written (Statista). Historically, life insurance has never really been “bought”, it’s been “sold”. It is a sector dominated by telephony based brokers and offline sales, and one that has frankly not been suited to any form of scale. Protection products are most commonly sold offline by advisors because of their complexity, and the underwriting process can involve a multitude of questions and at times even doctor visits. The policies are often fixed and customers rarely have an easy option to update their policies through their life or as their circumstances change. This makes the customer journey unpleasant, with the prices offered unrepresentative of the consumer’s situation and as a result, leaving a significant proportion of the population uninsured. In the UK this translates into 50% of mortgages, 9m families, 4m self-employed and many more unprotected.

In some ways, the Covid-19 pandemic may well be to insurance what the 2008 financial crash was to banking. This could particularly be said of the life insurance industry, which has seen a renewed interest from mass market consumers, and more importantly the younger demographics. The pandemic has put a spotlight on the need for mortality protection and potential healthcare expenditure which has spurred an increase in appetite for life insurance with customer demand currently at an all-time high.

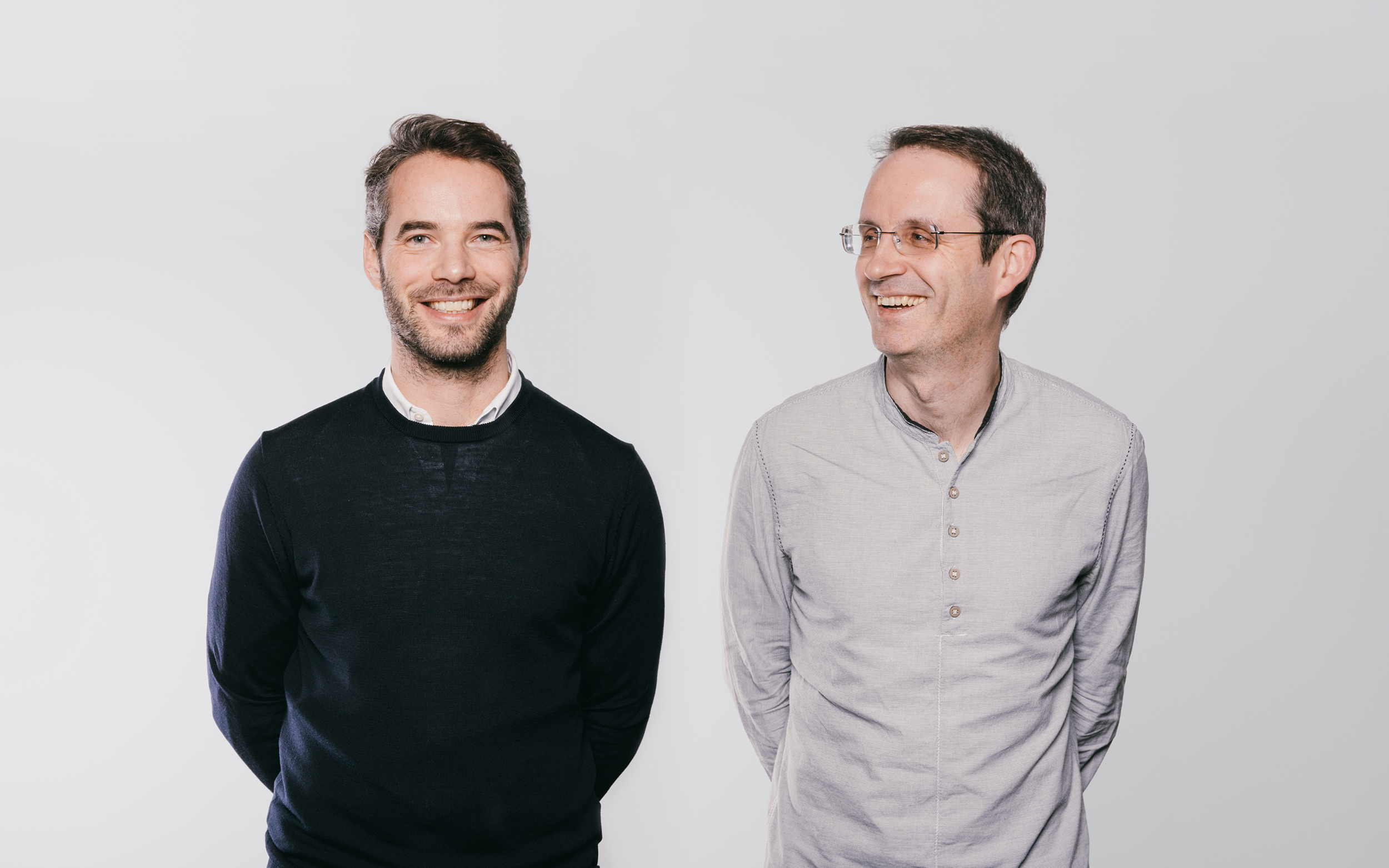

Founders David Vanek and Vincent Durnez are a tenacious management team that bring together all the ingredients for success– strong technical know-how, understanding of an omnichannel product approach, old world insurance experience, and a never say die attitude.

Furthermore, there has also been a fundamental shift in the way people consume financial services, moving towards a concept of embedded finance. In the same way, embedded insurance offers the ability to seamlessly bring insurance products to a captive audience in customer journeys they already love and trust – unlocking lower cost distribution to more individuals, increased access to data and reduced underwriting risks.

This brings us on to Anorak. Founders David Vanek and Vincent Durnez are a tenacious management team that bring together all the ingredients for success– strong technical know-how, understanding of an omnichannel product approach, old world insurance experience, and a never say die attitude. With early backing from AXA as part of a venture build with Kamet Ventures which involved deep market research, Anorak was born as the first of its kind life insurance advice platform. David and Vincent now lead a team of 28 other ‘anoraks’, and have created a new formula to bring protection products into the 21st century. Anorak as it exists today enables mass market customers to receive affordable, relevant and personalised insurance advice when and where they need it most – the key here being that Anorak is built to be an embedded solution distributed via partners.

It’s not often we come across companies that have built a true technology moat and fostering real innovation in the way the product is engineered

It’s not often we come across companies that have built a true technology moat and fostering real innovation in the way the product is engineered. The Anorak team have spent countless hours refining the tech and informing their ‘advisor’ models giving them a unique ability to understand and compute any individuals’ financial situation thereby offering instant product recommendations. Anorak are using a differentiated play book for their distribution strategy (B2B2C), and the ultimate vision is to become the go-to infrastructure layer for everyday insurance advice, accessible across any channel.

In the last twenty years, the protection gap doubled mainly due to a lack of awareness and a lack of effective innovation across the industry (Swiss Re Institute). While affluent individuals will remain the most important customer segment, we believe mass-market millennials, Generation Xers and the middle-market baby boomers will represent the next horizon of growth.

We have already seen the first wave of insurtech innovators achieve rapid growth in the P&C world. Contemporaneously, Anorak is quietly leading the charge to reimagine the way the life insurance is transacted. Outward is excited to be on this journey in supporting the Anorak team on their mission to become the world’s smartest insurance companion.

About the author

Sanchit Dhote

Investment Manager

Sanchit used to spend half his day as an engineer and the other half as a football coach, which meant that he was always searching for answers. After building a unique perspective he forged an unexpected path into venture capital and has become an integral part of Outward. Beyond work, Sanchit is usually found travelling to watch live sport or visiting family in his hometown of Bombay.